Get the free gst284 form

Show details

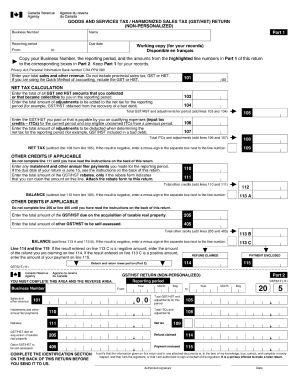

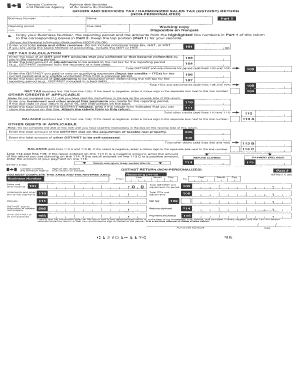

HST Rebate Calculation for Parishes in the Diocese of London Revised February 1, 2011, The formula below will assist you in calculating your HST rebates and claim the rebate on form GST284 E (10)

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your gst284 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your gst284 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit gst284 online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit gst284e form blank. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out gst284 form

How to fill out gst284:

01

Start by obtaining the GST284 form, which can be found on the official website of the tax authority or obtained from a local tax office.

02

Carefully read the instructions and guidelines provided with the form to ensure accurate completion.

03

Begin by entering your personal information, including your name, address, and contact details, in the specified sections of the form.

04

Identify your tax registration number or business number and record it in the appropriate field.

05

Fill in the reporting period for which you are submitting the GST284 form. This period should match the duration for which you are reporting your GST obligations.

06

Report your total GST/HST net tax for the reporting period, ensuring that you accurately calculate the amount and enter it in the respective section.

07

Provide details of any adjustments or corrections that need to be made to the previously reported net tax amount, if applicable.

08

If you are entitled to any GST/HST refunds or credits, indicate the amount in the relevant section.

09

Review the completed form to ensure accuracy and make any necessary corrections before submitting it to the appropriate tax authority.

Who needs gst284:

01

Businesses registered for Goods and Services Tax (GST) or Harmonized Sales Tax (HST) in Canada need to file the GST284 form.

02

Individuals or entities engaged in commercial activities and meeting the prescribed thresholds for GST/HST registration are required to submit this form.

03

Any organization or individual involved in the supply of goods or services, including non-resident businesses providing taxable supplies in Canada, should complete the GST284 form to fulfill their tax obligations.

Fill gst284 e form : Try Risk Free

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is gst284?

GST284 is an introductory course at Simon Fraser University in Canada. It provides an introduction to the principles of taxation, including an overview of the principles of Canadian income tax law.

How to fill out gst284?

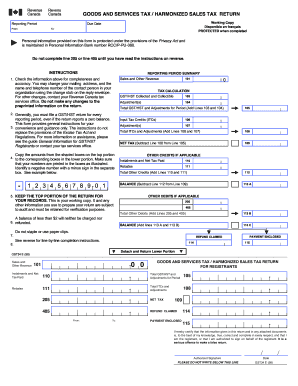

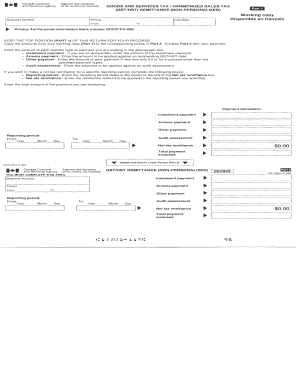

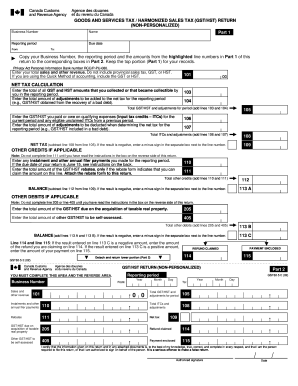

1. On the first page, enter your business information including GST/HST number, business name, and address.

2. On the second page, enter the details of your GST/HST remittance period, including the period start and end dates.

3. On the third page, enter all of your GST/HST collected or collected and paid during the period, as well as any adjustments or credits you are claiming.

4. On the fourth page, enter the total amount of GST/HST that you are remitting.

5. On the fifth page, enter the information of the person or business that is responsible for remitting the GST/HST.

6. Finally, sign and date the form to complete it.

What is the penalty for the late filing of gst284?

The penalty for the late filing of a GST284 form depends on the severity of the case. Generally, the penalty is a fine of up to 5% of the total tax payable, or a minimum of $10, whichever is greater.

Who is required to file gst284?

GST form 284, known as Goods and Services Tax/Harmonized Sales Tax (GST/HST) Return for Registrants, is required to be filed by businesses in Canada who are registered for the GST/HST. This form is used to report and remit the GST/HST collected and claim input tax credits.

What is the purpose of gst284?

GST284 is a form used by Canadian residents to apply for the Canada Workers Benefit (CWB), which is a tax credit program that provides financial support to low-income individuals or families who are working and earning income. The purpose of GST284 is to gather information about an individual's or family's income, employment status, and number of dependents to determine their eligibility and calculate the amount of benefits they are entitled to receive. The CWB aims to help individuals and families with modest income levels by supplementing their earnings and providing financial assistance.

What information must be reported on gst284?

The following information must be reported on GST284 form:

1. The name, address, and business number of the registrant.

2. The filing period or reporting period (date range covered by the report).

3. The total amount of GST/HST collected on taxable supplies made in the reporting period.

4. The total amount of GST/HST collected on imported taxable supplies in the reporting period.

5. The total amount of GST/HST collected on specified supplies made in the reporting period.

6. The total amount of GST/HST collected on goods and services acquired in Canada in the reporting period.

7. The total amount of GST/HST paid or payable on specified supplies made in the reporting period.

8. The total amount of GST/HST paid or payable on imported taxable supplies in the reporting period.

9. The total amount of GST/HST paid or payable on purchases and expenses made in Canada in the reporting period.

10. The total amount of GST/HST refund claimed in the reporting period.

11. The net amount of GST/HST payable or refundable in the reporting period.

12. Any adjustments to previous reporting periods, if applicable.

13. The signature or electronic filing identification, date, and contact information of the person completing the form.

Please note that this information may vary depending on the specific circumstances and requirements of the business. It is recommended to consult the official instructions or guidelines provided by the Canada Revenue Agency (CRA) for the most accurate and up-to-date information.

How can I modify gst284 without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including gst284e form blank. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How can I get gst284 e 15 x form?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific gst 284e fillable pdf and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

Can I create an electronic signature for signing my gst284 form pdf in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your gst284 e form directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

Fill out your gst284 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

gst284 E 15 X Form is not the form you're looking for?Search for another form here.

Keywords relevant to gst 284 e form

Related to form gst284e

If you believe that this page should be taken down, please follow our DMCA take down process

here

.